Despite ongoing annual proclamations that Charlottesville City Government is cash starved, a cursory analysis of the city’s proposed 2012-13 Operating & Capital Budget shows that nothing could be further from the truth.

This year, Charlottesville City Hall is “swimming in cash”—as it has been for the last decade and beyond, running up cumulative surpluses in the tens-of-millions of dollars and then allocating those funds to “pet” projects, outside of the standard budget process. But in their frenzy to spend every available collected cent, Charlottesville City Council has shown the hapless taxpayer no substantive relief.

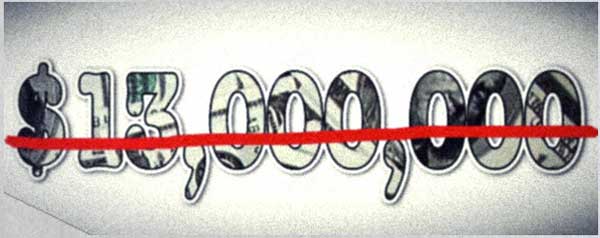

In order to jump-start the proscribed “where to cut” discussion, The Schilling Show has proposed more than $13M in red-pen savings: these for consideration by the fiscally clueless City Council Democrats who in 2013 joyfully will fritter $146,183,446 of OPM (other people’s money).

While the list is by no means exhaustive, it is predicated on Constitutional principles of limited government, long forgotten (if ever known) by Charlottesville’s Democrat ruling class.

The city’s projected 2013 real estate tax collection is $50M. With each penny of the real estate tax dollar representing about $525,000 ($50M/95) these identified savings embody a potential real estate tax rate reduction of approximately 25 cents ($13M/$525k)—which would drop the current taxation rate of .95 per hundred to .70 per hundred. The resulting 26% ($13M) reduction in tax confiscations—while painful to profligate Democrat insiders and their political beneficiaries—likely would be a boon to the local economy and a blessing to economically struggling families in Charlottesville.

(H/T to Steven Latimer for providing the red pen!)

Review the Righteous Red Pen Budget Analysis and Proposed Savings (feel free to add your own):

| Department | Item | Budgeted $ | Reduction | Balance |

| Schools | City Increase | $3,400,000 | $3,400,000 | $- |

| General | Bonus | $825,000 | $825,000 | $- |

| Housing | C’ville Housing Fund | $1,410,000 | $1,410,000 | $- |

| Parks | Parkland Acquisition | $95,000 | $95,000 | $- |

| Parks | Trails and Trees | $124,515 | $124,515 | $- |

| Parks | Bicycle Infrastructure | $100,000 | $100,000 | $- |

| City Council | Slush fund | $178,000 | $168,000 | $10,000 |

| City Council | Clerk | $208,583 | $52,146 | $156,437 |

| City Manager | Communications Dept. | $347,029 | $260,272 | $86,757 |

| Healthy Families | Visitors Bureau | $615,014 | $307,507 | $307,507 |

| Healthy Families | Community Festivals/Events | $112,900 | $56,450 | $56,450 |

| Economic Dev. | Administration | $699,991 | $349,995 | $349,996 |

| Management | Organizational Memberships | $145,032 | $108,774 | $36,258 |

| Non-departmental | Sister Cities | $15,000 | $15,000 | $- |

| Non-departmental | Dialogue on Race | $90,000 | $90,000 | $- |

| Fund Balance | Target Adjustment | $500,000 | $500,000 | $- |

| Training | Corp. Training Fund | $35,000 | $17,500 | $17,500 |

| Training | Misc. Exp. (Awards, etc.) | $225,000 | $112,500 | $112,500 |

| SOCA | Children, family services | $10,250 | $10,250 | $- |

| Computers4Kids | Children, family services | $18,646 | $18,646 | $- |

| MACAA | Children, family services | $197,255 | $49,314 | $147,941 |

| JABA | Children, family services | $306,499 | $76,625 | $229,874 |

| United Way | Children, family services | $177,155 | $88,576 | $88,579 |

| PACEM | Children, family services | $10,500 | $5,250 | $5,250 |

| Center for Arts | Education and Arts | $31,958 | $31,958 | $- |

| McGuffey | Education and Arts | $22,740 | $22,740 | $- |

| Municipal Band | Education and Arts | $72,885 | $72,885 | $- |

| WVPT | Education and Arts | $2,009 | $2,009 | $- |

| Piedmont Arts | Education and Arts | $23,749 | $23,749 | $- |

| Discovery Museum | Education and Arts | $4,359 | $4,359 | $- |

| Literacy Volunteers | Education and Arts | $28,390 | $28,390 | $- |

| Ashlawn Highland | Education and Arts | $4,550 | $4,550 | $- |

| Preservation Task Force | Education and Arts | $5,000 | $5,000 | $- |

| AA Teaching Fellows | Education and Arts | $5,250 | $5,250 | $- |

| Housing | Tax Grant | $450,000 | $450,000 | $- |

| Housing | AHIP | $95,546 | $95,546 | $- |

| Housing | PHA | $106,580 | $106,580 | $- |

| N’hood Development | Administration | $2,792,038 | $2,233,630 | $558,408 |

| Transit | Greyhound | $62,923 | $62,923 | $- |

| CIP | Police Firing Range | $576,711 | $576,711 | $- |

| CIP | Reeves Park | $750,000 | $375,000 | $375,000 |

| CIP | Azalea Park | $375,000 | $375,000 | $- |

| CIP | YMCA Pool | $625,000 | $625,000 | $- |

| Health Care | Emp. Fitness Program | $215,000 | $215,000 | $- |

| Total Savings | $13,557,600 |

Read our special report on how Charlottesville City can reduce its real estate tax rate by 25 cents. A little red ink and some intestinal fortitude will yield $13M in savings.

Albemarle County, you're next!

http://wp.me/p1x2fK-1H4

Well done Rob.

Yes well done rob, however the handout crowd will not know what to do? I have asked the question in past of city Government and never get answer. What is cost ratio benifit for each and every program the city support?

Employee fittness Program seem to be really working, I drove by a road crew and 5 of crew could not see their feet from a standing position.

But remember dear citizen of charlottesville — when don’t get butt out of bed or made effort to vote, you end up this mess in city hall, enjoying giving your hard earned money away.

Why do you want to cut the schools? You hate kids!

The issue is as the number of school age child has decreased over last several yrs. One would expect the school budget to go down. Instead the budget has gone up. Due to the declining school age population, the city could afford to close one of the elementary and combine it with another one. The city could afford to combine both mid-school into one and close the other. Instead it is easier to just keep asking for more and more money instead of doing their jobs. The issue has and alway will be out of control city council that enjoy spending money for ideas that give them a warm and fuzzy feeling instead of focusing on core functions. But than I am just old man.

Dear Rob, This list raises so many questions about

the City’s spending. For example, why is there such

a large projected expenditure for the Clerk of City

Council’s budget?

the city is like a leech.

What Rob seems to want is a citizenry too stingy to provide hand-up-not-out services for poor, and too dull to appreciate the arts. A budget like that would drive so many smart, creative people out of the city that the tax base would shrink like crazy and the budget would never balance.

@Ken: I have been a singer and actress in community theatres for 35 years in a dozen or so locations up and down the east coast. In addition, I advanced to directing productions in Charlottesville and Culpeper for about 10 years and I was one of the earliest organizers and founders of the Play On theatre company in C’ville.

A community can demonstrate plenty of “appreciation” for the arts without the infusion of tax dollars. Theatre companies need money to operate, yes — but when it comes to tax dollars, they are not typically the entities that receive funds from local government. Those groups tend to be things like municipal bands, arts-in-the-park, and community-center based youth arts programs.

Often, when theatre folk try to raise money they are told “we already support local arts through our taxes.” So not only do I support the principle of the taxpayers keeping more of their own money so THEY have the privilege of deciding where it will go on its own merits, but also because in theory ALL arts groups would have an equal shot through their efforts at a piece of the pie. And I think that creates a more diverse arts community.

People love the arts and they won’t shrink and die because the only way they will get funded is by compulsory “donation” via the tax system.

Carole, thank you for your contribution to the arts here in Charlottesville. I’m not sure why you distinguish between theater and other groups, but the Municipal Band is one of the groups Rob would defund. The Municipal Band, WVPT, McGuffey and other groups listed above provide access to the arts for people who can’t afford to pay for them or lack the education to appreciate them (arts education in the schools being another expenditure conservatives are always complaining about).

All or most of these groups rely on donations as well as tax dollars, so their continued existence shows that the community values them.

If stay up and watch last night city council meeting. There were adults there basely begging for money. Doesn’t matter that the city property owners are one’s who are paying for these program. It is time for us to standup to city council and say no more. Some of the organization listed in Rob’s article, I no longer give them a donation.

I am tired of being expected to pay for the City Council Social Engineering Agenda. No as a conservative I don’t care if they teach art in school or not. I do care when the school age population is going down and the budget keep going up. There is something wrong with this.

Ken the Democrat — a reason some folks cannot afford to patronize the arts is because they are being overtaxed by the city or county government. Let them owe fewer taxes to the localities and they can vote with their dollars.

City Council along with the City Managers office is a farce. Believe me they will know how to spend the excess money they have. Invent a job (take away from Peter to give work to Paul)make sure a hefty salary is thrown in. Rob, don’t give up you are not yet digging deep enough.

Those of us who love a thriving city with a diverse population (including low income families) and an appreciation for the value of a variety of local cultural opportunities will keep voting for council members who feel the same. Tea Baggers can move to Mississippi, Texas or Oklahoma if they need a different environment.